MobiKwik is an Indian technology firm that has turned out to be one of the premier fintech companies in the country, with more than millions of users availing their digital payment services and financial products. The company is listed on the National Stock Exchange (NSE) under MOBIKWIK and also the Bombay Stock Exchange (BSE) as One MobiKwik Systems Limited.

Share price of Mobikwik is also live checked by investors regularly to keep them updated of the stress in the market to make necessary decisions. Since its listing, the stock has remained in focus with attention drawn towards both the short term and the long- term investors who are optimistic about the expansion in the digital finance industry of India.

Depending on the demand in the marketplace, business performance, and economic fashions, the price of Mobikwik shares fluctuates throughout the trading day. The One MobiKwik share price NSE which is the NSE quote of the One MobiKwik quote gives the real time view of One MobiKwik share dealings, and the Mobikwik share price BSE quote provides the counterpart view of the same to the investors looking at more than one exchange. Investors also monitor the Mobikwik share price target given by analysts which may guide on sound investment decisions. Knowing these figures is crucial not only to professional traders but also to the prospective investors who would like to venture the stock market with clear minds and bold hearts.

MobiKwik Share Price Today – Live Updates and Quick Facts

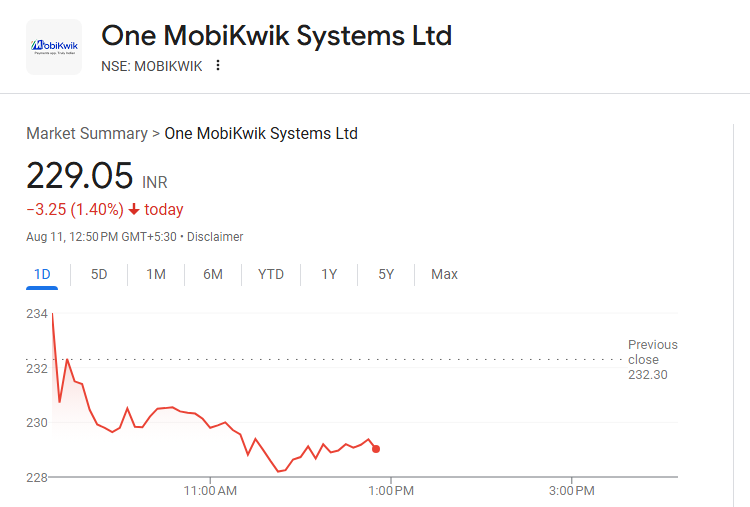

The MobiKwik share price live shows how the stock is performing in real time on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). Prices move up or down during market hours based on trading activity, news updates, and investor sentiment. Keeping track of the live price helps investors make faster and more informed decisions.

Below is a quick snapshot of key details for One MobiKwik Systems Limited share price. The figures in this table should be updated regularly to keep the information accurate and useful for readers.

MobiKwik Share Price Snapshot (as of August 11, 2025)

| Detail | NSE (₹) | BSE (₹) |

| Current Price | 229.05 | 229.05 |

| Day’s Change (%) | −1.32% | −1.42% |

| 52-Week High | 698.30 | 698.30 |

| 52-Week Low | 226.85 | 226.85 |

| Market Capitalisation (Cr) | ~1,796 | ~1,796 |

| Face Value | 2.00 | 2.00 |

MobiKwik Price History and IPO Journey

One MobiKwik Systems Limited entered the stock market with its much-anticipated Initial Public Offering (IPO) in December 2024. The IPO attracted strong attention from retail and institutional investors, reflecting the growing interest in India’s fintech sector. The company set its issue price within the ₹265–₹279 range, and the Mobikwik share price NSE opened at a premium on listing day. Many early investors saw quick gains, while others viewed the listing as a long-term opportunity.

Since its IPO the share price of Mobikwik has seen both the bullish rallying and profit taking period. Some of the factors that have affected market movements have been in quarterly earnings, adoption of the use of digital payment, new product launch and the general sentiment in the stock market. The Mobikwik share price BSE has been in tandem with the trends in NSE with a slight difference because they are being traded independently with different exchanges. The stock has recorded many highs over the years and has moved into support areas as well, providing some valuable information to investors on its volatility and its growth estimations.

Tracking the mobikwik share price live alongside historical data allows investors to understand how the stock reacts to market events. This perspective is especially valuable for those looking at the mobikwik share price target for the coming months or years, as it provides a realistic view of possible price movements based on past patterns and performance.

Read Also: Zepto Share Price: Latest Updates, Trends & Analysis

Factors Influencing MobiKwik Share Price

The MobiKwik share price is shaped by a mix of internal company performance and external market forces. Investors tracking the mobikwik share price live should understand these factors to make informed decisions.

1. Company Performance

Quarterly earnings, revenue growth, and profitability play a big role in determining the One MobiKwik share price NSE and mobikwik share price BSE. Positive financial results, such as higher transaction volumes or increased user growth, often push the share price up. On the other hand, losses or missed earnings expectations can put downward pressure on the stock.

2. Industry and Market Trends

As a fintech company, MobiKwik operates in a fast-growing yet competitive sector. Government policies, digital payment adoption rates, and competition from rivals like Paytm and PhonePe can directly impact investor sentiment. A strong industry outlook can support the share price of Mobikwik, while regulatory changes may create short-term volatility.

3. Investor Sentiment and News Flow

Market mood can change quickly based on news headlines. Announcements about partnerships, new services, or regulatory approvals can lift the mobikwik share price NSE, while negative news can cause sharp declines. Global market conditions, foreign investments in the fintech sector, and broader stock market trends also influence the price.

4. Technical Factors

Chart patterns, trading volume, and key price levels—such as 52-week highs and lows—affect short-term price moves. Many traders use these technical indicators to decide entry and exit points, which can create quick price swings in the mobikwik share price live.

MobiKwik Share Price Target and Future Outlook

Analysts typically give a Mobikwik share price target that indicates whether the company would perform well, excel in the market, and expand. These targets do not come as a surety, but they will give the investors a stone in the short and long terms on the direction that the stock is likely to take. One MobiKwik share price NSE and Mobikwik share price BSE are subjected to fluctuation with the happenings in the Indian digital payments business and the capacity of the company to creatively develop.

In the short term, price targets depend heavily on quarterly earnings, transaction volume growth, and any major product launches. Positive news in these areas can help the share price of Mobikwik approach or even exceed its projected targets. However, investors should also be aware of market corrections and profit-taking phases that can temporarily bring the mobikwik share price live lower.

From a long-term perspective, MobiKwik’s growth potential lies in increasing its customer base, expanding financial services, and strengthening partnerships with merchants. If the company continues to improve its revenue and profitability, it could push the Mobikwik share price target higher over time. Still, market risks, regulatory changes, and rising competition remain factors that could influence the final outcome.

Conclusion and Investor Takeaways

The MobiKwik share price reflects both the opportunities and challenges of India’s fast-moving fintech market. Whether you follow the mobikwik share price live on the NSE or track it on the BSE, understanding its movement is key to making smart investment choices. Short-term price changes can be driven by news, earnings, and market sentiment, while long-term growth depends on the company’s ability to expand its services and maintain a competitive edge.

Investors must monitor the one mobikwik share price NSE and mobikwik share price BSE and other major financial news and trends. Set defined intentions; whether to make quick trades or to hold the stock in the long run and this will increase your ability to use the information to your advantage. Frequent monitoring, together with a healthy perception with respect to risks and returns can assist in making better decisions.

Because no investment lacks the risk factor, being more knowledgeable can carry a long way forward. With live updates, price history data and expert analysis in terms of projections on Mobikwik share price targets, one will soon be able to treat such stock with increased confidence and a plan that will work towards achieving his or her financial objectives.

7 Comments

Its like you read my mind You appear to know so much about this like you wrote the book in it or something I think that you can do with a few pics to drive the message home a little bit but other than that this is fantastic blog A great read Ill certainly be back

Hello my loved one I want to say that this post is amazing great written and include almost all significant infos I would like to look extra posts like this

Excellent blog here Also your website loads up very fast What web host are you using Can I get your affiliate link to your host I wish my web site loaded up as quickly as yours lol

Your writing has a way of resonating with me on a deep level. I appreciate the honesty and authenticity you bring to every post. Thank you for sharing your journey with us.

I do trust all the ideas youve presented in your post They are really convincing and will definitely work Nonetheless the posts are too short for newbies May just you please lengthen them a bit from next time Thank you for the post

My brother suggested I might like this blog He was totally right This post actually made my day You can not imagine simply how much time I had spent for this info Thanks

What i do not understood is in truth how you are not actually a lot more smartlyliked than you may be now You are very intelligent You realize therefore significantly in the case of this topic produced me individually imagine it from numerous numerous angles Its like men and women dont seem to be fascinated until it is one thing to do with Woman gaga Your own stuffs nice All the time care for it up