Tesla stock has become one of the most popular and discussed investments in the world. The company behind it, Tesla, Inc., is known for its electric vehicles, clean energy products, and bold vision for the future. Investors follow Tesla closely because it continues to lead the global shift toward electric cars and sustainable technology. As the company grows, many people want to understand how its stock performs and whether it is a smart investment.

Tesla trades under the symbol TSLA on the NASDAQ exchange. Over the years, its stock price has experienced strong highs and sharp drops. This movement makes it exciting but also challenging for new investors. Factors like production numbers, new product launches, AI advancements, and market trends can affect the stock’s value. Understanding these elements helps investors make informed decisions.

This pillar page gives you a complete guide to Tesla stock. You will learn how it works, what influences its price, and whether it fits your investment goals. The aim is to provide clear, reliable, and easy-to-read information so you can understand Tesla stock without confusion.

What Is Tesla Stock?

Tesla stock refers to the publicly traded shares of Tesla, Inc., one of the leading companies in electric vehicles, clean energy, and advanced technology. The stock trades under the ticker symbol TSLA on the NASDAQ exchange. When investors buy Tesla stock, they buy a small ownership share in the company. This ownership connects them to Tesla’s performance in areas like electric cars, battery technology, autonomous driving, and renewable energy solutions.

Tesla stock has gained massive attention because the company continues to grow its global presence. Tesla builds electric vehicles, solar products, and large-scale energy storage systems. It also invests heavily in artificial intelligence, self-driving software, and robotics. These business areas create strong interest from long-term investors who believe in the future of clean transportation and smart energy. As a result, TSLA often reacts to product updates, delivery numbers, new factories, and innovations like Full Self-Driving and Optimus Robot.

For investors, Tesla stock is more than just a share price. It represents a fast-moving company that influences the global EV market. Understanding what TSLA is and how the company earns revenue helps investors study future growth, risks, and opportunities. Whether you are a beginner or an experienced trader, learning the basics of Tesla stock is the first step to making smart investment decisions.

History of Tesla Stock

The history of Tesla stock begins with its initial public offering (IPO) on June 29, 2010. Tesla went public at a price of $17 per share, raising funds to expand its electric vehicle production and technology development. At that time, Tesla was a small company with only one car model, the original Roadster. Many investors were unsure about the future of electric vehicles, but the IPO marked the start of Tesla’s journey in the stock market. Over the years, TSLA has shown strong growth, becoming one of the most valuable automakers in the world.

Several major events have shaped the movement of Tesla stock. The launch of the Model S, Model 3, Model X, and Model Y brought new interest from the market as Tesla proved it could produce high-quality electric cars at scale. The opening of Gigafactories in the United States, China, and Europe increased production capacity and improved investor confidence. Tesla also completed multiple stock splits, which made individual shares more affordable for retail investors. Another major milestone was Tesla’s inclusion in the S&P 500 index in 2020, which increased demand for its shares from institutional investors and index funds.

Tesla stock has experienced strong growth, but it has also faced volatility. News about production challenges, competition from companies like BYD and Rivian, regulatory decisions, and CEO Elon Musk’s announcements have all influenced price changes. Despite the ups and downs, Tesla’s long-term stock history shows how innovation and global demand for electric vehicles continue to drive interest in TSLA. Understanding these historical moments helps investors see how the company evolved and what factors shaped its stock performance over time.

Tesla Stock Price Overview

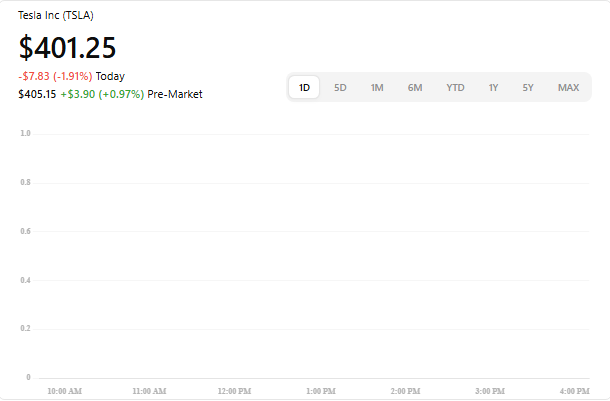

Tesla stock price changes often because the company operates in a fast-growing and competitive industry. TSLA is known for its high price swings, which attract both long-term investors and short-term traders. The stock reacts quickly to news about production numbers, quarterly earnings, new vehicle launches, and updates related to Full Self-Driving or AI technology. As a result, Tesla stock remains one of the most watched and analyzed stocks in the global market.

Several key factors influence the daily movement of Tesla’s share price. Investor sentiment plays a big role, especially because Tesla is linked to future technologies like autonomous driving, robotics, and clean energy storage. Market conditions also matter. Interest rates, inflation, and global economic trends can push the price up or down. Company decisions such as opening new Gigafactories, expanding into new markets, or improving battery technology also affect TSLA’s performance.

Along with these factors, comparison with competitors like BYD, NIO, Rivian, and Lucid impacts how investors view Tesla’s growth potential. Analysts also track Tesla’s vehicle deliveries, revenue growth, and margins to evaluate the stock’s value. Understanding these price drivers helps investors make better decisions. A clear view of Tesla’s stock price trends gives insight into where the company stands today and where it may be heading in the future.

What Drives Tesla Stock?

Tesla stock moves for many reasons, and understanding these factors helps investors study its long-term potential. TSLA is influenced by company performance, market demand, and global economic trends. Since Tesla leads the electric vehicle industry, even small updates about its production, technology, or strategy can affect the stock price. Investors closely follow the company because it operates in fast-growing areas like EVs, clean energy, AI, and self-driving technology.

Production and Delivery Numbers

Tesla’s quarterly production and delivery reports are one of the biggest drivers of TSLA. Higher delivery numbers show strong demand and improved manufacturing efficiency. Lower numbers can signal challenges in supply chains, factory operations, or market demand. Investors use these reports to understand the company’s growth direction.

Revenue and Profit Margins

Tesla’s financial performance has a direct impact on its stock. Rising revenue, strong profit margins, and healthy cash flow often boost investor confidence. When Tesla faces rising costs or shrinking margins, the stock may fall. Earnings reports, revenue forecasts, and guidance from leadership all influence Tesla stock trends.

Innovation and Technology Growth

Tesla is not just a car company. Innovations like Full Self-Driving (FSD), Autopilot, AI training, and the Optimus Robot can increase excitement around TSLA. Progress in battery technology, energy storage, and new product lines also helps strengthen Tesla’s market position and stock performance.

Competition in the EV Market

Tesla competes with brands like BYD, NIO, Rivian, and Ford EV. When competitors introduce new models or show rapid growth, investors compare their progress with Tesla’s. Strong competition can affect Tesla’s market share and influence its stock price.

Elon Musk’s Influence

Elon Musk plays a major role in shaping investor sentiment. His announcements, decisions, and public statements often cause quick reactions in the stock market. As Tesla’s CEO, Musk’s leadership style and long-term vision are major factors behind investor confidence.

Government Policies and Global Demand

Global policies promoting clean energy, EV tax credits, and emission rules directly impact Tesla. When countries support electric vehicle adoption, Tesla benefits. Changes in regulations, interest rates, and global economic stability also affect TSLA.

Understanding these key factors helps investors see why Tesla stock behaves the way it does. Each of these elements shapes market sentiment and contributes to the short-term and long-term movement of TSLA.

Tesla Stock Analysis

Analyzing Tesla stock helps investors understand its true value, strengths, and long-term potential. TSLA is known for its rapid growth, strong brand power, and high volatility. A clear analysis includes studying financial performance, market trends, chart patterns, and investor sentiment. This approach gives a complete picture of how Tesla performs today and what may influence its future.

Fundamental Analysis

Fundamental analysis focuses on Tesla’s business performance. Investors look at revenue growth, profit margins, production capacity, and cash flow. Tesla earns money from electric vehicles, solar energy products, energy storage systems, and software features like Full Self-Driving. Analysts check quarterly earnings, operating costs, and expansion plans to understand how these areas support long-term growth. Metrics like the price-to-earnings ratio, price-to-sales ratio, and market cap also help measure whether the stock is priced fairly.

Technical Analysis

Technical analysis studies price charts and market data. Traders track trends, candlestick patterns, and support and resistance levels to predict short-term movements of TSLA. Volume indicators, moving averages, and RSI are often used to understand whether the stock is in an uptrend or downtrend. Because Tesla is highly reactive to news, technical signals help traders plan entry and exit points.

Sentiment Analysis

Sentiment plays a major role in Tesla’s stock performance. Public opinion, news coverage, and social media trends often influence how investors feel about TSLA. Positive updates about new models, factory growth, or earnings can push the stock up. Negative headlines about delays, competition, or regulatory challenges can create downward pressure. Analyst ratings and forecasts also shape investor expectations.

A balanced analysis that includes fundamental, technical, and sentiment insights helps investors make informed decisions. It provides a strong understanding of how Tesla operates today and what factors may influence its stock performance in the future.

Is Tesla Stock a Good Investment?

Tesla stock attracts both beginner and professional investors because of its strong brand, innovative technology, and long-term vision. TSLA has delivered impressive growth over the years, but it is also known for sharp price swings. Whether Tesla is a good investment depends on your goals, risk level, and understanding of how the company operates. Evaluating the advantages and challenges helps you decide if TSLA fits your investment strategy.

Pros of Investing in Tesla Stock

Tesla leads the global electric vehicle market and continues to expand with new Gigafactories, improved battery technology, and advanced software. The company invests heavily in AI, Full Self-Driving, clean energy, and robotics, which creates strong long-term growth potential. Tesla’s brand loyalty and large customer base also support its position in the industry. Many investors see Tesla as more than a car company because it operates in several high-growth sectors, including renewable energy and autonomous driving.

Cons and Risks of Investing

Tesla stock is highly volatile. Its price often reacts to news, production reports, competition, and statements from leadership. Rising competition from BYD, NIO, Rivian, and traditional automakers may affect Tesla’s market share. Global economic conditions, interest rates, and supply chain issues can also impact the company’s performance. For some investors, this level of uncertainty creates risk.

Long-Term vs. Short-Term Potential

Tesla may suit long-term investors who believe in the future of electric vehicles, energy storage, and AI-driven transportation. The company has ambitious plans, including robotaxi networks and large-scale energy solutions, which could support long-term growth. However, short-term traders must be ready for frequent price changes and sudden market reactions. Understanding your investment style helps you decide if TSLA aligns with your goals.

Overall, Tesla stock can be a strong investment for those who understand the risks and believe in the company’s long-term future. A balanced approach and proper research can help you invest with confidence.

Tesla Stock Forecast and Predictions

Tesla stock forecast helps investors understand where TSLA might be heading in the coming months and years. Predicting the exact price is not possible, but analysts study market trends, company performance, and future plans to estimate its potential growth. Tesla operates in fast-growing sectors like electric vehicles, clean energy, and autonomous driving, which adds strong long-term opportunities. At the same time, changing market conditions can influence how the stock performs in the short run.

Short-Term Forecast

Short-term predictions for Tesla often depend on quarterly earnings, production numbers, and market sentiment. When Tesla reports strong delivery results or launches new features like improvements in Full Self-Driving, the stock usually reacts positively. However, news about competition, supply chain issues, or delays can impact TSLA negatively. Analysts often expect Tesla stock to remain volatile in the short term because it reacts quickly to global events and company announcements.

Medium-Term Forecast

In the next one to two years, Tesla’s growth may depend on expanding factories, new vehicle models, and improvements in manufacturing costs. Projects like Cybertruck production, global Gigafactory growth, and new battery technology can support stable performance. Analysts also focus on Tesla’s ability to maintain strong demand in key markets such as China, Europe, and the United States. If Tesla continues to deliver consistent revenue growth and stronger margins, the stock may show steady upward movement.

Long-Term Predictions

Long-term predictions often highlight Tesla’s potential in advanced areas like autonomous driving, robotaxis, energy storage, and AI-powered robotics. If Tesla becomes a leader in self-driving technology, the stock could experience significant long-term growth. The company’s plan to build affordable EVs and expand energy products also supports future expansion. Many analysts believe Tesla has strong long-term potential if it continues to innovate and maintain its market leadership.

Tesla stock forecasts show a mix of opportunity and uncertainty. Investors who study these predictions gain a clearer picture of Tesla’s future possibilities while understanding the risks that come with its high volatility.

How to Buy Tesla Stock

Buying Tesla stock is simple, and both beginners and experienced investors can follow a few easy steps to get started. Before investing, it is important to understand your financial goals and risk level because TSLA can be a highly volatile stock. Once you are ready, you can use an online broker, trading app, or investment platform to complete the process. The steps are straightforward and work in most countries.

Step 1: Choose a Reliable Broker or Trading Platform

Start by selecting a trustworthy brokerage platform that allows you to buy and sell stocks listed on the NASDAQ exchange. Popular brokers include Robinhood, eToro, TD Ameritrade, Interactive Brokers, Fidelity, and Webull. Make sure the platform offers low fees, simple navigation, and secure transactions. If you live outside the United States, choose a platform available in your region that supports international stock trading.

Step 2: Create and Verify Your Account

After choosing a broker, you need to create an account by submitting your basic information. Most platforms require identity verification to ensure safety and compliance with regulations. This may include your ID card, phone number, and address.

Step 3: Add Funds to Your Account

Once your account is verified, you can deposit money to buy Tesla stock. Most brokers accept bank transfers, debit cards, and sometimes e-wallets. Choose a method that is fast and safe. Make sure the amount you deposit matches your investment plan and risk tolerance.

Step 4: Search for Tesla Stock (TSLA)

In your trading app, search for Tesla stock using the ticker symbol TSLA. The stock’s profile page will show real-time price charts, company information, and analyst ratings.

Step 5: Choose How Many Shares to Buy

Decide how many shares or fractional shares you want to purchase. Fractional shares are a good option if you want to invest a smaller amount, especially because TSLA can be expensive at times.

Step 6: Place Your Order

Select the order type you prefer:

- Market Order: Buys the stock instantly at the current price.

- Limit Order: Buys the stock only when it reaches your chosen price.

Review your order and confirm it when you are ready.

Step 7: Monitor Your Investment

After buying Tesla stock, keep track of company news, quarterly earnings, and market trends. Staying updated helps you understand how your investment is performing and whether you need to adjust your strategy.

Buying Tesla stock is a simple process, but smart investing requires research, patience, and consistent monitoring. Understanding each step helps you make confident decisions as you build your investment portfolio.

Tesla Stock Dividends

Tesla stock does not pay dividends, and the company has made it clear that it plans to reinvest its profits back into growth. Unlike traditional automakers that offer regular dividend payments, Tesla focuses on expanding its production capacity, improving battery technology, and advancing its software and AI projects. This strategy supports long-term growth, but it means that investors do not receive direct income from dividends.

The company believes that reinvesting earnings will create stronger value for shareholders over time. Tesla continues to spend heavily on new Gigafactories, Full Self-Driving development, energy storage technology, and robotics. These investments require large amounts of capital, which is why the company avoids paying dividends. Instead, Tesla aims to increase shareholder value through long-term stock appreciation.

Although Tesla does not currently offer dividends, some investors still see it as a strong growth stock. The company’s expansion into new markets, improvements in manufacturing, and progress in self-driving technology may support future growth in revenue and stock price. If Tesla eventually reaches a stage where growth slows and cash reserves increase, it may consider paying dividends. For now, Tesla remains a growth-focused company that prioritizes innovation over dividend payouts.

Tesla Stock Split History

Tesla stock has gone through multiple stock splits to make its shares more affordable for retail investors and increase market participation. A stock split does not change the overall value of the company. It only increases the number of shares while reducing the price per share. Tesla uses this strategy to improve liquidity, attract new investors, and keep TSLA accessible to the general public.

2020: 5-for-1 Stock Split

Tesla announced its first major modern stock split in August 2020. Each shareholder received five shares for every one share they held. This move came after a significant rise in Tesla’s stock price, which made it difficult for new investors to buy a single share. The split lowered the price per share and increased trading activity.

2022: 3-for-1 Stock Split

In August 2022, Tesla completed another stock split, this time on a 3-for-1 basis. The goal was the same: make the stock more accessible and improve liquidity. The split helped bring more retail investors into the market and increased interest in TSLA.

Why Tesla Splits Its Stock

Tesla usually chooses stock splits after a strong period of price growth. When the share price becomes too high, fewer people can afford to buy it. A split solves this issue by reducing the price per share without changing the company’s total market value. The strategy also helps maintain steady demand and keeps the stock attractive to new investors.

Tesla’s stock split history shows the company’s focus on accessibility and growth. While splits do not affect Tesla’s financial health, they play an important role in making TSLA easier to trade and own. Investors often view stock splits as a sign of confidence in the company’s long-term performance.

Tesla Stock vs. Competitors

Tesla competes with several companies in the electric vehicle and clean energy markets. Understanding how Tesla compares with its competitors helps investors analyze its strengths and weaknesses. While Tesla leads in brand value, charging infrastructure, and software, other companies are growing quickly and challenging its market share. Key competitors include BYD, Rivian, NIO, Lucid, and traditional automakers entering the EV space.

Tesla vs. BYD

BYD, a Chinese EV manufacturer, is one of Tesla’s strongest competitors. BYD produces a wide range of electric and hybrid vehicles at affordable prices. It has a strong presence in China, which is the world’s largest EV market. Tesla focuses more on premium electric vehicles, while BYD targets the mass market. Both companies continue to expand globally, making them top competitors in the EV industry.

Tesla vs. Rivian

Rivian is known for its electric trucks and SUVs. The company targets consumers who want adventure-style vehicles with advanced technology. Rivian has gained attention for its battery performance and durable designs. While it is still a younger company compared to Tesla, Rivian competes in the growing EV truck and SUV segment, which may influence Tesla’s market share.

Tesla vs. NIO

NIO focuses on high-tech, premium electric vehicles in China. It is known for its battery-swapping technology, which allows drivers to replace batteries in minutes. This innovation helps NIO stand out in the EV market. While Tesla operates globally, NIO has built a strong presence in China and continues to expand into Europe.

Tesla vs. Lucid Motors

Lucid produces luxury electric vehicles with long driving ranges and advanced interiors. The Lucid Air is known for its premium performance and efficiency. While Lucid aims at the luxury EV market, Tesla competes at both the premium and mid-range levels. Lucid’s focus on luxury places it in competition with Tesla’s higher-end models like the Model S and Model X.

Traditional Automakers Entering the EV Market

Companies like Ford, Volkswagen, BMW, and Hyundai are now investing heavily in electric vehicles. These brands already have strong manufacturing experience and global networks. Their entry into the EV market increases competition for Tesla, especially in pricing and vehicle variety.

Tesla remains a leader in the EV industry, but competition continues to grow. Each competitor offers unique strengths, and understanding these differences helps investors evaluate Tesla’s long-term position.

Tesla Stock ETFs

Investing in Tesla does not always require buying TSLA directly. Many investors choose ETFs (Exchange-Traded Funds) that include Tesla as one of their top holdings. ETFs offer a simple way to invest in multiple companies at once, which reduces risk and provides diversification. For investors who want exposure to Tesla and other leading tech or clean energy companies, ETFs can be a smart option.

Popular ETFs That Hold Tesla Stock

Several well-known ETFs include Tesla as a major part of their portfolio. These funds focus on technology, innovation, clean energy, and the overall stock market. Some of the most popular ETFs that hold TSLA include:

- ARK Innovation ETF (ARKK): Tesla is often one of the top holdings due to its role in disruptive technology and autonomous driving.

- Invesco QQQ Trust (QQQ): This ETF tracks the NASDAQ-100, which includes Tesla along with other major tech companies.

- SPDR S&P 500 ETF Trust (SPY): Since Tesla is part of the S&P 500 index, this ETF automatically includes TSLA.

- Vanguard Total Stock Market ETF (VTI): This fund provides exposure to the entire U.S. stock market, including Tesla.

- iShares Global Clean Energy ETF (ICLN): Tesla appears in many clean energy ETFs due to its solar and battery technology.

Benefits of Investing Through ETFs

Investing in Tesla stock through ETFs offers several advantages. First, it reduces the risk of depending on a single company’s performance. If Tesla experiences volatility, other strong companies in the ETF can balance the impact. Second, ETFs are professionally managed and rebalanced, making them a convenient choice for long-term investors. Finally, ETFs require less research and allow beginners to invest in Tesla without dealing with daily price swings.

Who Should Consider Tesla ETFs?

ETFs are suitable for investors who want exposure to Tesla but prefer a safer and more diversified approach. They fit well for long-term retirement plans, stable portfolios, and investors who want to avoid high volatility. Those who prefer direct investment and higher potential returns may still choose individual Tesla shares instead.

Tesla ETFs offer a balanced way to invest in the company while benefiting from broader market stability. They help investors enjoy Tesla’s growth potential with reduced risk and a more stable investment experience.

Best Strategies to Invest in Tesla Stock

Investing in Tesla stock requires a clear plan because TSLA can move quickly and react strongly to market news. Choosing the right strategy helps you reduce risk and improve your long-term results. Different investors follow different methods based on their budget, goals, and risk tolerance. Here are some of the most effective strategies for investing in Tesla.

Buy and Hold Strategy

The buy and hold strategy works well for investors who believe in Tesla’s long-term future. Tesla operates in high-growth sectors like electric vehicles, clean energy, and autonomous driving. These industries may continue to expand for many years. By holding TSLA for the long term, investors can benefit from future innovations, factory expansions, and new technologies. This strategy requires patience and a long-term mindset.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a simple method where you invest a fixed amount of money in Tesla stock at regular intervals. Instead of trying to find the perfect time to buy, you invest weekly, monthly, or quarterly. This reduces the impact of market volatility because you buy shares at both high and low prices. DCA is a smart strategy for beginners and helps build a stable long-term portfolio.

Swing Trading

Swing trading focuses on short-term price movements. Traders buy Tesla stock when the price dips and sell it when the price rises. This method requires studying trends, charts, and technical indicators. Since Tesla stock often moves quickly due to news or earnings, swing traders look for opportunities within short time frames. This strategy can offer fast profits, but it also carries higher risk.

Options Trading

Experienced traders sometimes use options to invest in Tesla. Call options allow traders to bet on the stock going up, while put options bet on it going down. Options trading requires knowledge of market behavior and risk management. It can offer high rewards, but it can also lead to losses if the market moves unexpectedly. This strategy is not recommended for beginners.

Fractional Share Investing

If the price of Tesla stock feels too high, you can buy fractional shares. This allows you to invest any amount you want rather than buying a full share. It is a great option for new investors or those with a smaller budget. Fractional investing makes it easier to start building a position in TSLA without waiting for lower prices.

Choosing the right strategy depends on your risk level and financial goals. Whether you hold Tesla stock for years or trade it actively, understanding these strategies can help you invest more confidently and effectively.

Risks of Investing in Tesla Stock

Investing in Tesla stock offers strong growth potential, but it also comes with risks that investors should understand before buying TSLA. The company operates in a competitive and fast-changing industry, and its stock is known for sharp price swings. Being aware of these risks helps you make smarter investment decisions and plan a strategy that fits your financial goals.

High Volatility

Tesla stock often moves up and down quickly. Its price reacts strongly to news, earnings reports, production numbers, and even social media comments from Elon Musk. This volatility can create opportunities for traders, but it also increases the risk of sudden losses for long-term investors.

Rising Competition

Tesla faces strong competition from other electric vehicle manufacturers. Companies like BYD, NIO, Rivian, Ford, Volkswagen, and Hyundai are rapidly growing their EV lines. As more brands enter the market, Tesla may find it challenging to maintain its market share and pricing power. Increased competition can affect growth and investor confidence.

Production and Supply Chain Challenges

Tesla depends on large-scale manufacturing, and any disruption in its supply chain can impact production. Delays in battery supply, chip shortages, or factory shutdowns can affect vehicle deliveries and financial performance. These issues can push the stock price down in the short term.

Regulatory and Legal Risks

Tesla operates in many countries, each with different regulations for safety, emissions, and self-driving technology. New rules or legal challenges can slow down product launches or increase costs. Investigations related to Autopilot or Full Self-Driving can also influence Tesla’s public image and stock movement.

Dependence on Elon Musk

Elon Musk’s leadership is a major reason behind Tesla’s success. However, the company depends heavily on his vision and decisions. Musk’s involvement in other businesses and public statements can affect investor sentiment. Sudden changes in leadership or controversial announcements may influence the stock price.

Economic Conditions

Global economic trends, interest rates, inflation, and currency changes can affect Tesla’s performance. Higher interest rates can reduce consumer spending on vehicles, especially expensive ones like Teslas. Economic downturns can also impact demand for EVs and slow company growth.

Understanding these risks helps investors prepare for challenges and manage their portfolios more effectively. Tesla remains a strong growth company, but smart investing requires recognizing both its opportunities and potential downsides.

How to Analyze Tesla Stock for Long-Term Investments

Analyzing Tesla stock for long-term investments requires a clear understanding of the company’s core strengths, financial health, and future opportunities. Long-term investors focus on stability, growth potential, competitive advantages, and industry demand. Tesla offers all these factors, but each area needs proper evaluation before making an informed decision.

Start by checking Tesla’s financial fundamentals. Look at revenue growth, profit margins, operating expenses, and cash flow trends. Strong financial results show that the company can sustain its operations and invest in new technologies. Investors also review Tesla’s delivery numbers because they reflect real consumer demand. Long-term growth depends on consistent performance in these key areas.

Next, consider Tesla’s business model and competitive position. The company’s strength lies in its electric vehicle manufacturing, battery development, and AI-based autonomous driving. Tesla also invests heavily in software, energy storage, and charging technology. These segments support long-term revenue streams and help Tesla compete with other automakers. When analyzing the stock for long-term investment, look at how Tesla expands into global markets, builds new factories, and introduces innovations. These efforts strengthen its growth potential and give investors more confidence in the company’s future.

Tesla stock is also influenced by external factors like government EV policies, raw material prices, global chip supply, and competition. Long-term investors should stay updated on market news and industry forecasts. Understanding these factors helps you decide whether Tesla is capable of long-term stability and value appreciation.

Expert Tips for New Tesla Investors

Investing in Tesla stock can be exciting, but it requires careful planning and research. TSLA is known for its high growth potential, but it is also volatile and influenced by many factors. Following expert tips can help new investors make informed decisions and reduce unnecessary risks.

Start With Research

Before buying Tesla stock, learn about the company, its products, competitors, and market trends. Study quarterly earnings reports, production numbers, and Tesla’s strategic plans. Understanding the business helps you evaluate its long-term growth potential and avoid making emotional decisions based on short-term price swings.

Set Clear Investment Goals

Decide whether you want to invest in Tesla for the long term or trade it for short-term profits. Long-term investors should focus on the company’s growth potential in EVs, AI, and energy sectors. Short-term traders should monitor daily price movements and news. Clear goals help you choose the right strategy and manage your risk effectively.

Diversify Your Portfolio

Even though Tesla is a popular stock, do not invest all your money in TSLA. Diversify your investments across other sectors, companies, or ETFs. Diversification reduces risk and protects your portfolio from unexpected market fluctuations. Tesla can be a valuable part of your portfolio, but it should not be the only holding.

Use Dollar-Cost Averaging

New investors can reduce the impact of market volatility by investing a fixed amount at regular intervals. This strategy, known as dollar-cost averaging, allows you to buy shares at different prices over time, minimizing the risk of investing a large sum at the wrong moment.

Stay Updated

Keep track of company news, production updates, and industry trends. Tesla stock often reacts to news about deliveries, new models, battery technology, and CEO statements. Staying informed helps you make timely decisions and avoid surprises.

Focus on Long-Term Potential

Tesla’s strength lies in innovation, technology, and market leadership. While the stock can fluctuate in the short term, long-term investors benefit from Tesla’s growth in electric vehicles, energy solutions, and autonomous driving technology. Patience and careful monitoring are key to making Tesla stock a successful investment.

Following these expert tips allows new investors to approach Tesla stock confidently. Research, strategy, and patience are essential to navigate the opportunities and risks of investing in one of the world’s most dynamic companies.

Conclusion

Tesla stock represents one of the most exciting investment opportunities in the modern market. As a leader in electric vehicles, clean energy, and advanced technology, Tesla continues to innovate and expand globally. Its stock, TSLA, reflects both the company’s rapid growth potential and the risks associated with a fast-changing industry.

Investing in Tesla requires understanding its business model, financial performance, market trends, and competitive landscape. Factors like production numbers, new product launches, technological advancements, and global policies on EVs all influence the stock. While Tesla is known for high volatility, long-term investors can benefit from its innovative projects and continued market leadership.

Frequently Asked Questions About Tesla Stock

Investors often have questions about Tesla stock because TSLA is one of the most widely followed and talked-about stocks in the market. Here are some of the most common questions and clear answers to help both beginners and experienced investors understand Tesla better.

1. What kind of stock is Tesla?

Tesla is a growth stock in the technology and automotive sectors. It represents a company leading in electric vehicles, energy storage, and solar products. Tesla stock is known for its high growth potential and price volatility, attracting investors seeking long-term gains.

2. What if I invested $1000 in Tesla 10 years ago?

If you had invested $1,000 in Tesla 10 years ago, your investment would have grown significantly, potentially turning into tens of thousands of dollars today, thanks to Tesla’s massive stock price increase and multiple stock splits over the years. The exact value depends on the timing of your purchase and any splits.

3. How much is Tesla stock to buy today?

Tesla stocks work like shares of ownership in Tesla, Inc. When you buy Tesla stock, you own a portion of the company and can benefit from its stock price appreciation and potential future profits. The stock price moves based on company performance, EV market trends, investor sentiment, and broader economic factors.

4. How much money can you make from Tesla stock?

The money you can make from Tesla stock depends on how much you invest, when you buy and sell, and the stock’s price movements. Gains come from stock price appreciation, and while Tesla has high growth potential, it is also volatile, so profits can be significant but are not guaranteed.